-

Capacitors

- Ceramic Capacitors

- Tantalum Capacitors

- Accessories

- Aluminum - Polymer Capacitors

- Aluminum Electrolytic Capacitors

- Capacitor Networks, Arrays

- Electric Double Layer Capacitors (EDLC), Supercapacitors

- Film Capacitors

- Mica and PTFE Capacitors

- Niobium Oxide Capacitors

- Silicon Capacitors

- Tantalum - Polymer Capacitors

- Thin Film Capacitors

- Trimmers, Variable Capacitors

-

Discrete Semiconductor Products

- Diodes - Bridge Rectifiers

- Diodes - Rectifiers - Arrays

- Diodes - Rectifiers - Single

- Diodes - RF

- Diodes - Variable Capacitance (Varicaps, Varactors)

- Diodes - Zener - Arrays

- Diodes - Zener - Single

- Power Driver Modules

- Thyristors - DIACs, SIDACs

- Thyristors - SCRs

- Thyristors - SCRs - Modules

- Thyristors - TRIACs

- Transistors - Bipolar (BJT) - Arrays

- Transistors - Bipolar (BJT) - Arrays, Pre-Biased

- Transistors - Bipolar (BJT) - RF

- Transistors - Bipolar (BJT) - Single

- Transistors - Bipolar (BJT) - Single, Pre-Biased

- Transistors - FETs, MOSFETs - Arrays

- Transistors - FETs, MOSFETs - RF

- Transistors - FETs, MOSFETs - Single

- Transistors - IGBTs - Arrays

- Transistors - IGBTs - Modules

- Transistors - IGBTs - Single

- Transistors - JFETs

- Transistors - Programmable Unijunction

- Transistors - Special Purpose

- Inductors, Coils, Chokes

-

Integrated Circuits (ICs)

- Audio Special Purpose

- Clock/Timing - Application Specific

- Clock/Timing - Clock Buffers, Drivers

- Clock/Timing - Clock Generators, PLLs, Frequency Synthesizers

- Clock/Timing - Delay Lines

- Clock/Timing - IC Batteries

- Clock/Timing - Programmable Timers and Oscillators

- Clock/Timing - Real Time Clocks

- Data Acquisition - ADCs/DACs - Special Purpose

- Data Acquisition - Analog Front End (AFE)

- Data Acquisition - Analog to Digital Converters (ADC)

- Data Acquisition - Digital Potentiometers

- Data Acquisition - Digital to Analog Converters (DAC)

- Data Acquisition - Touch Screen Controllers

- Embedded - CPLDs (Complex Programmable Logic Devices)

- Embedded - DSP (Digital Signal Processors)

- Embedded - FPGAs (Field Programmable Gate Array)

- Embedded - FPGAs (Field Programmable Gate Array) with Microcontrollers

- Embedded - Microcontroller or Microprocessor Modules

- Embedded - Microcontrollers

- Embedded - Microcontrollers - Application Specific

- Embedded - Microprocessors

- Embedded - PLDs (Programmable Logic Device)

- Embedded - System On Chip (SoC)

- Interface - Analog Switches - Special Purpose

- Interface - Analog Switches, Multiplexers, Demultiplexers

- Interface - CODECs

- Interface - Controllers

- Interface - Direct Digital Synthesis (DDS)

- Interface - Drivers, Receivers, Transceivers

- Interface - Encoders, Decoders, Converters

- Interface - Filters - Active

- Interface - I/O Expanders

- Interface - Modems - ICs and Modules

- Interface - Modules

- Interface - Sensor and Detector Interfaces

- Interface - Serializers, Deserializers

- Interface - Signal Buffers, Repeaters, Splitters

- Interface - Signal Terminators

- Interface - Specialized

- Interface - Telecom

- Interface - UARTs (Universal Asynchronous Receiver Transmitter)

- Interface - Voice Record and Playback

- Linear - Amplifiers - Audio

- Linear - Amplifiers - Instrumentation, OP Amps, Buffer Amps

- Linear - Amplifiers - Special Purpose

- Linear - Amplifiers - Video Amps and Modules

- Linear - Analog Multipliers, Dividers

- Linear - Comparators

- Linear - Video Processing

- Logic - Buffers, Drivers, Receivers, Transceivers

- Logic - Comparators

- Logic - Counters, Dividers

- Logic - FIFOs Memory

- Logic - Flip Flops

- Logic - Gates and Inverters

- Logic - Gates and Inverters - Multi-Function, Configurable

- Logic - Latches

- Logic - Multivibrators

- Logic - Parity Generators and Checkers

- Logic - Shift Registers

- Logic - Signal Switches, Multiplexers, Decoders

- Logic - Specialty Logic

- Logic - Translators, Level Shifters

- Logic - Universal Bus Functions

- Memory

- Memory - Batteries

- Memory - Configuration Proms for FPGAs

- Memory - Controllers

- PMIC - AC DC Converters, Offline Switchers

- PMIC - Battery Chargers

- PMIC - Battery Management

- PMIC - Current Regulation/Management

- PMIC - Display Drivers

- PMIC - Energy Metering

- PMIC - Full, Half-Bridge Drivers

- PMIC - Gate Drivers

- PMIC - Hot Swap Controllers

- PMIC - Laser Drivers

- PMIC - LED Drivers

- PMIC - Lighting, Ballast Controllers

- PMIC - Motor Drivers, Controllers

- PMIC - OR Controllers, Ideal Diodes

- PMIC - PFC (Power Factor Correction)

- PMIC - Power Distribution Switches, Load Drivers

- PMIC - Power Management - Specialized

- PMIC - Power Over Ethernet (PoE) Controllers

- PMIC - Power Supply Controllers, Monitors

- PMIC - RMS to DC Converters

- PMIC - Supervisors

- PMIC - Thermal Management

- PMIC - V/F and F/V Converters

- PMIC - Voltage Reference

- PMIC - Voltage Regulators - DC DC Switching Controllers

- PMIC - Voltage Regulators - DC DC Switching Regulators

- PMIC - Voltage Regulators - Linear

- PMIC - Voltage Regulators - Linear + Switching

- PMIC - Voltage Regulators - Linear Regulator Controllers

- PMIC - Voltage Regulators - Special Purpose

- Specialized ICs

- Isolators

- Relays

-

RF/IF and RFID

- Attenuators

- Balun

- RF Accessories

- RF Amplifiers

- RF Antennas

- RF Demodulators

- RF Detectors

- RF Diplexers

- RF Directional Coupler

- RF Evaluation and Development Kits, Boards

- RF Front End (LNA + PA)

- RF Misc ICs and Modules

- RF Mixers

- RF Modulators

- RF Power Controller ICs

- RF Power Dividers/Splitters

- RF Receiver, Transmitter, and Transceiver Finished Units

- RF Receivers

- RF Shields

- RF Switches

- RF Transceiver ICs

- RF Transceiver Modules

- RF Transmitters

- RFI and EMI - Contacts, Fingerstock and Gaskets

- RFI and EMI - Shielding and Absorbing Materials

- RFID Accessories

- RFID Antennas

- RFID Evaluation and Development Kits, Boards

- RFID Reader Modules

- RFID Transponders, Tags

- RFID, RF Access, Monitoring ICs

- RF Circulators and Isolators

-

Sensors, Transducers

- Accessories

- Amplifiers

- Capacitive Touch Sensors, Proximity Sensor ICs

- Color Sensors

- Current Transducers

- Dust Sensors

- Encoders

- Flex Sensors

- Float, Level Sensors

- Flow Sensors

- Force Sensors

- Gas Sensors

- Humidity, Moisture Sensors

- Image Sensors, Camera

- IrDA Transceiver Modules

- Magnetic Sensors - Compass, Magnetic Field (Modules)

- Magnetic Sensors - Linear, Compass (ICs)

- Magnetic Sensors - Position, Proximity, Speed (Modules)

- Magnetic Sensors - Switches (Solid State)

- Magnets - Multi Purpose

- Magnets - Sensor Matched

- Motion Sensors - Accelerometers

- Motion Sensors - Gyroscopes

- Motion Sensors - IMUs (Inertial Measurement Units)

- Motion Sensors - Inclinometers

- Motion Sensors - Optical

- Motion Sensors - Tilt Switches

- Motion Sensors - Vibration

- Multifunction

- Optical Sensors - Ambient Light, IR, UV Sensors

- Optical Sensors - Distance Measuring

- Optical Sensors - Mouse

- Optical Sensors - Photo Detectors - CdS Cells

- Optical Sensors - Photo Detectors - Logic Output

- Optical Sensors - Photo Detectors - Remote Receiver

- Optical Sensors - Photodiodes

- Optical Sensors - Photoelectric, Industrial

- Optical Sensors - Photointerrupters - Slot Type - Logic Output

- Optical Sensors - Photointerrupters - Slot Type - Transistor Output

- Optical Sensors - Phototransistors

- Optical Sensors - Reflective - Analog Output

- Optical Sensors - Reflective - Logic Output

- Position Sensors - Angle, Linear Position Measuring

- Pressure Sensors, Transducers

- Proximity Sensors

- Proximity/Occupancy Sensors - Finished Units

- Sensor Cable - Accessories

- Sensor Cable - Assemblies

- Sensor Interface - Junction Blocks

- Shock Sensors

- Solar Cells

- Specialized Sensors

- Strain Gauges

- Temperature Sensors - Analog and Digital Output

- Temperature Sensors - NTC Thermistors

- Temperature Sensors - PTC Thermistors

- Temperature Sensors - RTD (Resistance Temperature Detector)

- Temperature Sensors - Thermocouple, Temperature Probes

- Temperature Sensors - Thermostats - Mechanical

- Temperature Sensors - Thermostats - Solid State

- Ultrasonic Receivers, Transmitters

- Camera Modules

- LVDT Transducers (Linear Variable Differential Transformer)

- Optical Sensors - Photonics - Counters, Detectors, SPCM (Single Photon Counting Module)

- Touch Sensors

-

Circuit Protection

- Accessories

- Circuit Breakers

- Electrical, Specialty Fuses

- Fuseholders

- Fuses

- Gas Discharge Tube Arresters (GDT)

- Ground Fault Circuit Interrupter (GFCI)

- Inrush Current Limiters (ICL)

- Lighting Protection

- PTC Resettable Fuses

- Surge Suppression ICs

- TVS - Diodes

- TVS - Mixed Technology

- TVS - Surge Protection Devices (SPDs)

- TVS - Thyristors

- TVS - Varistors, MOVs

- Thermal Cutoffs (Thermal Fuses)

-

Connectors, Interconnects

- Backplane Connectors - ARINC Inserts

- Backplane Connectors - ARINC

- Backplane Connectors - Accessories

- Backplane Connectors - Contacts

- Backplane Connectors - DIN 41612

- Backplane Connectors - Hard Metric, Standard

- Backplane Connectors - Housings

- Backplane Connectors - Specialized

- Banana and Tip Connectors - Accessories

- Banana and Tip Connectors - Adapters

- Banana and Tip Connectors - Binding Posts

- Banana and Tip Connectors - Jacks, Plugs

- Barrel - Accessories

- Barrel - Adapters

- Barrel - Audio Connectors

- Barrel - Power Connectors

- Between Series Adapters

- Blade Type Power Connectors - Accessories

- Blade Type Power Connectors - Contacts

- Blade Type Power Connectors - Housings

- Blade Type Power Connectors

- Card Edge Connectors - Accessories

- Card Edge Connectors - Adapters

- Card Edge Connectors - Contacts

- Card Edge Connectors - Edgeboard Connectors

- Card Edge Connectors - Housings

- Circular Connectors - Accessories

- Circular Connectors - Adapters

- Circular Connectors - Backshells and Cable Clamps

- Circular Connectors - Contacts

- Circular Connectors - Housings

- Circular Connectors

- Coaxial Connectors (RF) - Accessories

- Coaxial Connectors (RF) - Adapters

- Coaxial Connectors (RF) - Contacts

- Coaxial Connectors (RF) - Terminators

- Coaxial Connectors (RF)

- Contacts - Leadframe

- Contacts - Multi Purpose

- Contacts, Spring Loaded (Pogo Pins), and Pressure

- D-Shaped Connectors - Centronics

- D-Sub Connectors

- D-Sub, D-Shaped Connectors - Accessories - Jackscrews

- D-Sub, D-Shaped Connectors - Accessories

- D-Sub, D-Shaped Connectors - Adapters

- D-Sub, D-Shaped Connectors - Backshells, Hoods

- D-Sub, D-Shaped Connectors - Contacts

- D-Sub, D-Shaped Connectors - Housings

- D-Sub, D-Shaped Connectors - Terminators

- FFC, FPC (Flat Flexible) Connectors - Accessories

- FFC, FPC (Flat Flexible) Connectors - Contacts

- FFC, FPC (Flat Flexible) Connectors - Housings

- FFC, FPC (Flat Flexible) Connectors

- Fiber Optic Connectors - Accessories

- Fiber Optic Connectors - Adapters

- Fiber Optic Connectors - Housings

- Fiber Optic Connectors

- Heavy Duty Connectors - Accessories

- Heavy Duty Connectors - Assemblies

- Heavy Duty Connectors - Contacts

- Heavy Duty Connectors - Frames

- Heavy Duty Connectors - Housings, Hoods, Bases

- Heavy Duty Connectors - Inserts, Modules

- Keystone - Accessories

- Keystone - Faceplates, Frames

- Keystone - Inserts

- LGH Connectors

- Memory Connectors - Accessories

- Memory Connectors - Inline Module Sockets

- Memory Connectors - PC Card Sockets

- Memory Connectors - PC Cards - Adapters

- Modular Connectors - Accessories

- Modular Connectors - Adapters

- Modular Connectors - Jacks With Magnetics

- Modular Connectors - Jacks

- Modular Connectors - Plug Housings

- Modular Connectors - Plugs

- Modular Connectors - Wiring Blocks - Accessories

- Modular Connectors - Wiring Blocks

- Photovoltaic (Solar Panel) Connectors - Accessories

- Photovoltaic (Solar Panel) Connectors - Contacts

- Photovoltaic (Solar Panel) Connectors

- Pluggable Connectors - Accessories

- Pluggable Connectors

- Power Entry Connectors - Accessories

- Power Entry Connectors - Inlets, Outlets, Modules

- Rectangular Connectors - Accessories

- Rectangular Connectors - Adapters

- Rectangular Connectors - Arrays, Edge Type, Mezzanine (Board to Board)

- Rectangular Connectors - Board In, Direct Wire to Board

- Rectangular Connectors - Board Spacers, Stackers (Board to Board)

- Rectangular Connectors - Contacts

- Rectangular Connectors - Free Hanging, Panel Mount

- Rectangular Connectors - Headers, Male Pins

- Rectangular Connectors - Headers, Receptacles, Female Sockets

- Rectangular Connectors - Headers, Specialty Pin

- Rectangular Connectors - Housings

- Rectangular Connectors - Spring Loaded

- Shunts, Jumpers

- Sockets for ICs, Transistors - Accessories

- Sockets for ICs, Transistors - Adapters

- Sockets for ICs, Transistors

- Solid State Lighting Connectors - Accessories

- Solid State Lighting Connectors - Contacts

- Solid State Lighting Connectors

- Terminal Blocks - Accessories - Jumpers

- Terminal Blocks - Accessories - Marker Strips

- Terminal Blocks - Accessories - Wire Ferrules

- Terminal Blocks - Accessories

- Terminal Blocks - Adapters

- Terminal Blocks - Barrier Blocks

- Terminal Blocks - Contacts

- Terminal Blocks - Din Rail, Channel

- Terminal Blocks - Headers, Plugs and Sockets

- Terminal Blocks - Interface Modules

- Terminal Blocks - Panel Mount

- Terminal Blocks - Power Distribution

- Terminal Blocks - Specialized

- Terminal Blocks - Wire to Board

- Terminal Junction Systems

- Terminal Strips and Turret Boards

- Terminals - Accessories

- Terminals - Adapters

- Terminals - Barrel, Bullet Connectors

- Terminals - Foil Connectors

- Terminals - Housings, Boots

- Terminals - Knife Connectors

- Terminals - Magnetic Wire Connectors

- Terminals - PC Pin Receptacles, Socket Connectors

- Terminals - PC Pin, Single Post Connectors

- Terminals - Quick Connects, Quick Disconnect Connectors

- Terminals - Rectangular Connectors

- Terminals - Ring Connectors

- Terminals - Screw Connectors

- Terminals - Solder Lug Connectors

- Terminals - Spade Connectors

- Terminals - Specialized Connectors

- Terminals - Turret Connectors

- Terminals - Wire Pin Connectors

- Terminals - Wire Splice Connectors

- Terminals - Wire to Board Connectors

- USB, DVI, HDMI Connectors - Accessories

- USB, DVI, HDMI Connectors - Adapters

- USB, DVI, HDMI Connectors

- Crystals, Oscillators, Resonators

-

Development Boards, Kits, Programmers

- Accessories

- Evaluation Boards - Analog to Digital Converters (ADCs)

- Evaluation Boards - Audio Amplifiers

- Evaluation Boards - DC/DC & AC/DC (Off-Line) SMPS

- Evaluation Boards - Digital to Analog Converters (DACs)

- Evaluation Boards - Embedded - Complex Logic (FPGA, CPLD)

- Evaluation Boards - Embedded - MCU, DSP

- Evaluation Boards - Expansion Boards, Daughter Cards

- Evaluation Boards - LED Drivers

- Evaluation Boards - Linear Voltage Regulators

- Evaluation Boards - Op Amps

- Evaluation Boards - Sensors

- Evaluation and Demonstration Boards and Kits

- Programmers, Emulators, and Debuggers

- Programming Adapters, Sockets

- Software, Services

- UV Erasers

- Filters

- Memory Cards, Modules

- Potentiometers, Variable Resistors

- Power Supplies - Board Mount

- Power Supplies - External/Internal (Off-Board)

- Resistors

ON Semi Deepens Power Stake with Fairchild Acquisition | EE Times

The semiconductor industry consolidation continues. Companies with power management technology and products appear to be good bets.

ON Semiconductor announced Monday (Sept 19) the completion of its proposal to acquire Fairchild Semiconductor. The purchase, for $2.4 billion in cash, gives ON Semiconductor an expanded position in power semiconductors, particularly power transistors and diodes. The companies’ press materials suggest that the new $5-billion entity is now the number two in power transistor and diode shipments.

The acquisition of Fairchild Semiconductor is among the latest in a series of pairings reflecting industry-wide consolidation. It demonstrates a shared perception that semiconductors is now a BIG COMPANY business; that BIGNESS is a virtue enabling more rapid technology deployments and larger manufacturing capabilities — two conditions for success in a market whose growth has considerably slowed. This consolidation has proceeded for several years now, encouraged by the ultra-low price of capital, and — with multi-billion-dollar companies acquiring other multi-billion-dollar companies — few people are shocked at the scale of such acquisitions (like Avago’s acquisition of Broadcom for $37 billion, or SoftBank’s $32 billion acquisition of ARM Holdings).

What is new is the interest and value placed on power management IC suppliers. The ON Semi acquisition of Fairchild is a power management play, as is Renesas’ proposal to acquire Intersil (a transaction worth $3.2 billion), and Analog Devices’ proposal to acquire Linear Technology Corp. (a transaction worth $14.8 billion). The interest in analog and power technology extends to microcontroller makers like Microchip Technologies (who acquired Micrel) and processor makers like Mediatek (who acquired Richtek). These companies have used acquisitions to enable power management for their own advanced devices. It does a processor maker no good to build a 14nm device with 5 billion transistors on one chip — and send your customer elsewhere for solutions to the problems of powering it. (Qualcomm grew another billion-dollar business for itself by offering its own PMIC device for the Snapdragon chip sets.)

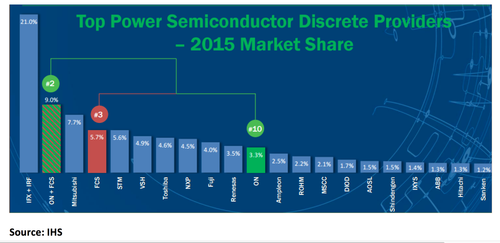

Leadership in this area will depend on possession of both power management devices (like voltage regulators) AND power transistors. Infineon is arguably the sales leader in discrete semiconductors (transistors and diodes) with 21% of the 2015 market, according to IHS Markit. (Prior to the acquisition, Fairchild held 5.7% of the discrete power semiconductor market, ON Semi held 3.3%.)

The acquisition of Fairchild by ON Semiconductor raises the profile of the combined company. ON Semiconductor becomes the industrys 2nd largest supplier, behind Infineon.

The acquisition of Fairchild by ON Semiconductor raises the profile of the combined company. ON Semiconductor becomes the industrys 2nd largest supplier, behind Infineon. Click here for larger image

The pairing of ON Semi and Fairchild deepens and balances ON Semiconductor’s portfolio of power management devices. ON Semiconductor’s portfolio was rich in “low-voltage” semiconductors, according to ON Semi president and CEO Keith Jackson, while Fairchild’s portfolio had serviced higher voltage applications. Despite their strengths in power discretes, there is little overlap in their portfolios, Jackson said.

The “new” ON Semiconductor is targeting markets in which the “old” ON Semi already enjoys considerable success. These include automotive products (such as MOSFET power train drivers, cameras and attachments for automotive safety) which accounted for 33% of ON Semi’s 2015 revenues. Industrial products (including motor drive circuits and transistors) accounted for 24% of ON Semi’s 2015 revenues. Communication circuits accounted for 18% of revenues.

Computing products only accounted for 12% of ON Semi’s 2015 revenues — odd, considering that ON retains a leadership position in power devices (like Vcore regulators) in desktop PCs and laptops. The reduced revenue is a reflection of a much reduced PC market, reminds David Somo, ON Semi’s vice president in charge of corporate strategy and marketing. ON Semi anticipates a near-term revenue boost with the roll-out of machines using the Intel Skylake processor family. (ON Semi’s Vcore regulator, a high-performance design purchased almost a decade ago from Analog Devices, enabled ON Semi’s leadership in the computer power market — where it also provided power MOSFETs — an item not then on Analog Devices’ menu.) The DrMOS products — MOSFET drivers authored by Fairchild — may alsocontribute to ON Semi’ penetration of the compute server market.

Following the acquisition of Fairchild , ON Semiconductor will reorganize itself into three “Solutions Groups” (SG), one for power (PSG), another for application-purpose analog (ASG) and a third for Imaging (ISG). Power Solutions Group includes power switching circuits, signal conditioning circuits, protection diodes, and voltage references. The Analog Solutions Group includes application-specific analog products, and its markets include automotive, industrial, communications, medical and military / aerospace products. The Image Sensor Group is built upon CMOS and CCD image sensors, proximity detectors and image signal processors for the automotive, medical, and aerospace applications

Related Posts

Comments (4)

-

Jessica MooreThis article about electronic components is well-written and informative. It covers a wide range of topics and provides valuable insights into the world of electronics. I found the explanations to be clear and easy to understand, even for someone with limited technical knowledge.November 30, 2019

Jessica MooreThis article about electronic components is well-written and informative. It covers a wide range of topics and provides valuable insights into the world of electronics. I found the explanations to be clear and easy to understand, even for someone with limited technical knowledge.November 30, 2019-

Adam TaylorI also enjoyed reading this article. It's great to see such clear explanations of complex topics. Looking forward to reading more from this author in the future.December 5, 2019

Adam TaylorI also enjoyed reading this article. It's great to see such clear explanations of complex topics. Looking forward to reading more from this author in the future.December 5, 2019

-

-

Ryan FordI completely agree with the previous reviewer. This article is an excellent resource for anyone interested in learning about electronic components. I particularly appreciated the section on common types of resistors and how to read their values. Keep up the good work!December 5, 2020

Ryan FordI completely agree with the previous reviewer. This article is an excellent resource for anyone interested in learning about electronic components. I particularly appreciated the section on common types of resistors and how to read their values. Keep up the good work!December 5, 2020

Write A Comment

Popular News

-

Vishay Intertechnology, Inc. (NYSE:VSH) has been assigned a consensus rating of ...Jul 13, 2017

-

Vishay Intertechnology, a Rare Tech Stock on SaleThe valuation of technology sto...Apr 24, 2017

-

Digital and memory ICs constitute about two-thirds of today's roughly $320 billi...Jul 14, 2017

-

Integrated Circuit,Diodes, Transistors,Semiconductors,Capacitance,resistance,Tan...Sep 5, 2017

-

HELLA Aglaia and NXP open visual platform for automated driving safety....Sep 13, 2017

.jpg)